Lazard (LAZ)·Q4 2025 Earnings Summary

Lazard Beats on Record Advisory Revenue, Asset Management Surges 18%

January 29, 2026 · by Fintool AI Agent

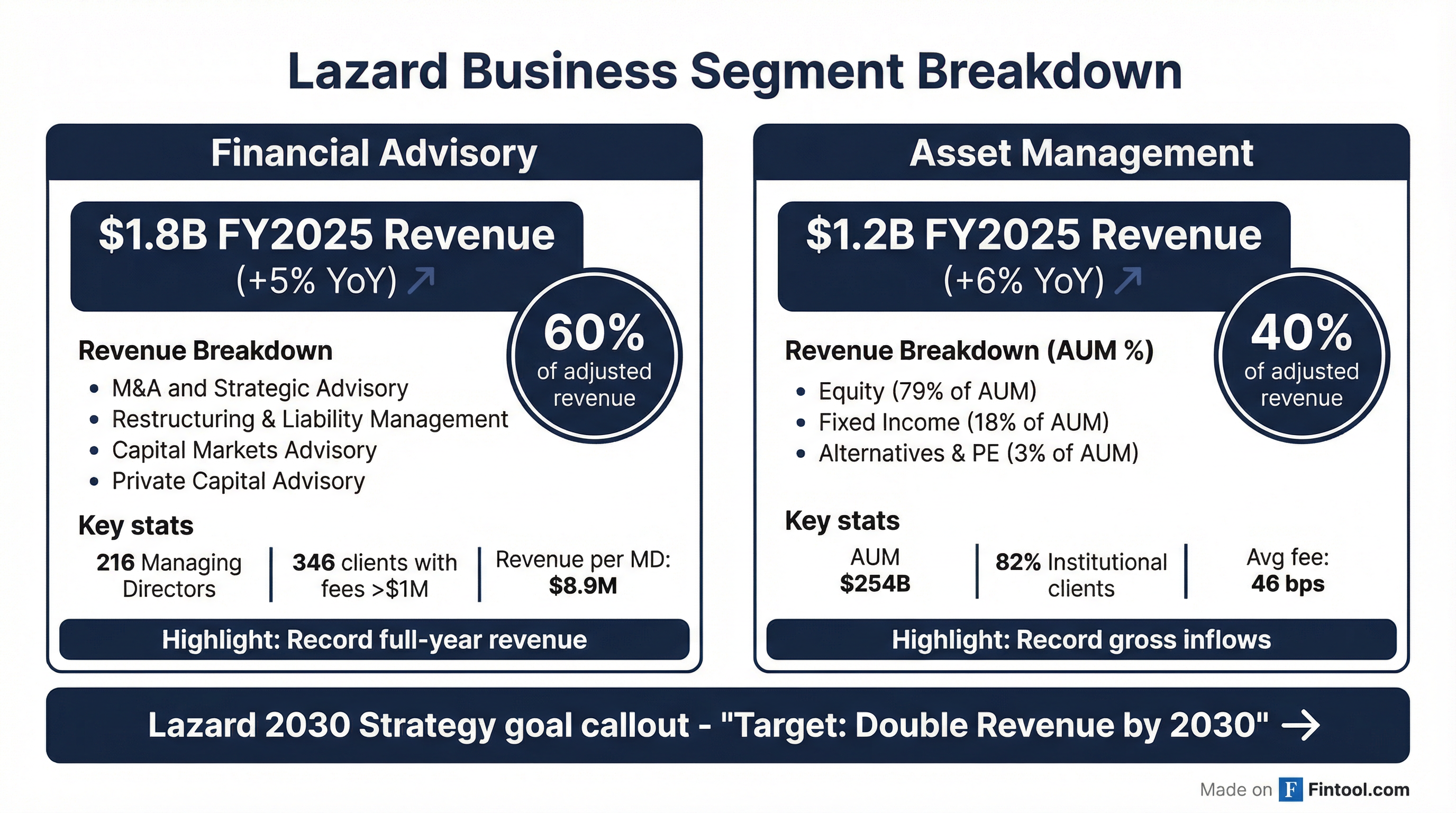

Lazard delivered a strong Q4 2025, beating consensus on both revenue and earnings while posting record full-year Financial Advisory revenue of $1.8 billion. Adjusted revenue of $892 million topped estimates by 8.7%, and adjusted EPS of $0.80 beat by 14.3%. The stock rose 2.3% in after-hours trading following the release.

CEO Peter Orszag highlighted the progress on the firm's 2030 growth strategy: "Efforts to transform both businesses over the past two years are gaining traction and delivering results. With favorable business conditions and strong client demand for contextual alpha—combining business decision-making with broader macroeconomic and geopolitical perspective—Lazard is well positioned for substantial growth opportunities ahead."

Did Lazard Beat Earnings?

Yes — Lazard beat on both revenue and EPS, extending its earnings beat streak to 8 consecutive quarters.

The GAAP earnings decline reflects $44 million in expenses associated with senior management transitions, which were excluded from adjusted results.

What Did Each Segment Deliver?

Financial Advisory: Record Year

Financial Advisory reported Q4 2025 revenue of $542 million, up 7% YoY, driven by strong M&A completion activity. Full-year 2025 achieved record revenue of $1.825 billion, up 5% from 2024.

Key transaction highlights during and since Q4 2025 include:

- Kellanova's $35.9 billion acquisition by Mars

- Constellation Energy's $26.6 billion acquisition of Calpine

- AkzoNobel's $25.0 billion combination with Axalta

- TPG's €6.7 billion acquisition of Techem

The firm hired 21 Managing Directors in 2025, ahead of its target of 10-15 net additions annually.

Asset Management: AUM Growth Accelerates

Asset Management delivered Q4 2025 revenue of $339 million, up 18% YoY, driven by higher average AUM and improved fee realization. Average AUM for Q4 was $261 billion with average fees of 46 bps—the highest fee rate in recent quarters.

Full-year 2025 saw record gross inflows exceeding the $50B target, though net outflows were driven by one large U.S. sub-advised relationship. Excluding that relationship, net inflows were $8.4 billion for the year.

Management is guiding for positive net flows in 2026. CEO Chris Hogbin stated the firm enters 2026 with "momentum" and a "healthy level of unfunded but not yet funded business at $13 billion." Key growth areas include emerging markets, systematic strategies, listed infrastructure, and alternatives.

What Changed From Last Quarter?

Revenue acceleration: Q4 adjusted revenue of $892M was up 23% sequentially from Q3's $725M, driven by typical Q4 seasonality in advisory completions.

Margin expansion: Operating margin improved to 16.7% in Q4 from 14.0% in Q3, reflecting operating leverage on higher revenue.

Fee realization improving: Average management fee rose to 46 bps from 44 bps in prior quarters, suggesting improved product mix toward higher-fee strategies.

Executive transition: Tracy Farr was appointed Chief Financial Officer, with $50 million in expenses associated with senior management transitions impacting GAAP results.

How Does Lazard Track Against 2030 Targets?

Lazard's "Lazard 2030" strategy aims to double revenue by 2030 from 2023 levels, achieve 10-15% annual total shareholder returns, and strengthen relevance with clients.

New productivity target announced in December: Lazard expanded its Lazard 2030 goals to include achieving $12.5 million in revenue per Managing Director by 2030, up from the current $8.9 million level.

Peter Orszag described a "coiled spring" effect: As the share of MDs new to Lazard's platform normalizes from ~40% currently to ~30% over time, productivity should rise by an estimated additional $1 million per MD—before accounting for other benefits like AI, better client traction, and disciplined fee structures.

How Did the Stock React?

Lazard shares closed at $52.61 on January 28, down 0.3% ahead of earnings. After-hours trading saw the stock rise to $53.84, up 2.3% following the results.

The stock has roughly doubled from its 52-week low, reflecting improved M&A activity and confidence in the Lazard 2030 strategy.

What About Capital Returns?

Lazard returned $393 million to shareholders in full-year 2025, including:

- Dividends: $187 million ($2.00 per share annually)

- Share repurchases: $91 million (1.9 million shares at avg $47.97)

- Tax withholding: $115 million on equity vesting

In Q4 2025 specifically, the company returned $98 million including $47 million in dividends and $50 million in buybacks.

The quarterly dividend of $0.50 per share was declared, payable February 20, 2026.

Balance sheet remains strong with $1.47 billion in cash and investment-grade credit ratings (BBB+/Baa3).

Q&A Highlights: What Management Said

On M&A and PE Activity Outlook

Peter Orszag sees M&A accelerating in 2026 despite policy uncertainty: "Unlike past cycles, we anticipate that M&A will increase alongside elevated restructuring and liability management activity as the result of an ongoing dispersion in corporate performance."

On private equity activity: "2026 is likely to be the year in which this occurs... LPs are getting increasingly desirous of some cash return, along with the narrowing of the bid-ask spread on valuations."

The revenue mix was just under 60% M&A and slightly over 40% non-M&A in 2025. Management expects non-M&A could rise to 50% over time through growth in fundraising, secondaries, and restructuring.

On Regional Trends and Geopolitics

"US CEOs seem a bit more confident than non-US CEOs right now. But we're seeing significant interest in transactions both in North America and Europe, and frankly, across the globe."

On the regulatory environment: "A lot of companies are realizing that the regulatory environment under the current administration is more accommodating to deals. It is also more political, but it is more accommodating."

On Asset Management Strategy

New CEO Chris Hogbin outlined three priorities:

- Delivering investment performance – Appointed Eric Van Nostrand as CIO to work across investment teams

- Scaling existing products – Focus on emerging markets, systematic, and listed infrastructure

- Driving efficiency – Appointed Rosalie Berman as COO to integrate AI and control costs

On inorganic opportunities: "We'll be highly selective... we do see the three drivers around us in public markets, privates, and then our wealth channel."

On AI and "Contextual Alpha"

Peter Orszag revealed the term "Contextual Alpha" – which describes Lazard's differentiated advice combining financial analysis with macro/geopolitical insight – came from an LLM: "About 3 or 4 months ago, I was inquiring how to describe what Lazard does, and it, not a human being, suggested the terminology Contextual Alpha."

On AI adoption: "My daily briefing is now increasingly done in the first instance with artificial intelligence... It makes it a much more interactive form of preparation for meetings."

Lazard has Perplexity's deputy, Dmitry Shevelenko, on its board – claimed to be the only Wall Street firm with a board member "native to AI."

Key Risks and Concerns

Net outflows history: Asset Management saw net outflows for FY25 driven by a large sub-advised relationship redemption. However, management noted there is "no flashing red concentration" like that going forward and the business is "much more diversified."

Compensation ratio elevated: At 65.5%, the compensation ratio remains well above the 60% target, pressuring margins. Management expects "additional operating leverage in 2026" as productivity gains offset hiring costs.

M&A cycle uncertainty: While management is optimistic, geopolitical tensions and policy uncertainty remain. Peter Orszag characterized early-2026 visibility as "low conviction... the uncertainty bands around how the year plays out at this time of the year is always very wide."

Restructuring cycle questions: Some peers have flagged an "ebb period" in restructuring. Lazard's counter-view: increased dispersion in corporate performance means restructuring and M&A can coexist—companies at the bottom of the distribution need liability management while frontier firms pursue acquisitions.

Management transition costs: The CFO transition and other executive changes resulted in one-time expenses impacting GAAP results.

What to Watch Going Forward

-

Q1 2026 M&A pipeline: Management sees a "nice build" in January activity. US CEO confidence is higher than non-US. Watch for PE sponsor exits as LPs push for cash returns.

-

Asset Management flows: Management explicitly guides for positive net flows in 2026. $13B in won-but-not-funded mandates provides visibility. No concentrated risk like the sub-advised relationship that drove 2025 outflows.

-

MD Productivity trajectory: Current $8.9M vs new $12.5M target by 2030. The "coiled spring" effect should kick in as the share of new MDs normalizes.

-

Non-comp expense guidance: CFO guided for mid-to-high single digit dollar increase in 2026, targeting return to the 16-20% non-comp ratio range as revenues grow.

-

CFO transition: Tracy Farr takes over with Mary Ann Betsch serving as senior advisor. His top priority: driving operating efficiencies in corporate functions.

Full-Year 2025 Summary

Note: Adjusted metrics are non-GAAP measures. See Lazard's Q4 2025 earnings press release for full reconciliations.

Explore More: